Tata Capital, a prominent financial services provider and a subsidiary of Tata Sons Pvt Limited, has recently announced a plan to consolidate its various subsidiaries in response to the changing regulatory landscapes. The company has a diverse portfolio in financial services aiming to streamline its operations and enhance its efficiency with this consolidation. This decision comes as a strategic response to the evolving dynamic market, allowing Tata Capital to position itself as a stronger and more integrated player in the financial services market.

In this blog, we will delve into the details of Tata Capital’s consolidation plan and how it will impact Tata Capital unlisted shares. Are you ready? Let’s start from scratch!

Insights Of Tata Capital: Have A Quick Look

Tata Capital Limited (TCL) was founded in 2007, headquartered in Mumbai. The company is registered with the Reserve Bank Of India as a Systemically Important Non-Deposit Accepting Core Investment Company (CIC). The company dominates the financial market and is incorporated under the Companies Act 2013.

Talking about its financial performance, the company has seen exponential growth in terms of profit. In FY2023, Tata Capital recorded the highest PAT ever of Rs. 2,975 cr., a straight growth of 80% YoY, while keeping the operational and crest costs under check. The Net Interest Margin (NIM) of FY23 is Rs. 7, 023, which is more than the previous of Rs. 5,253.

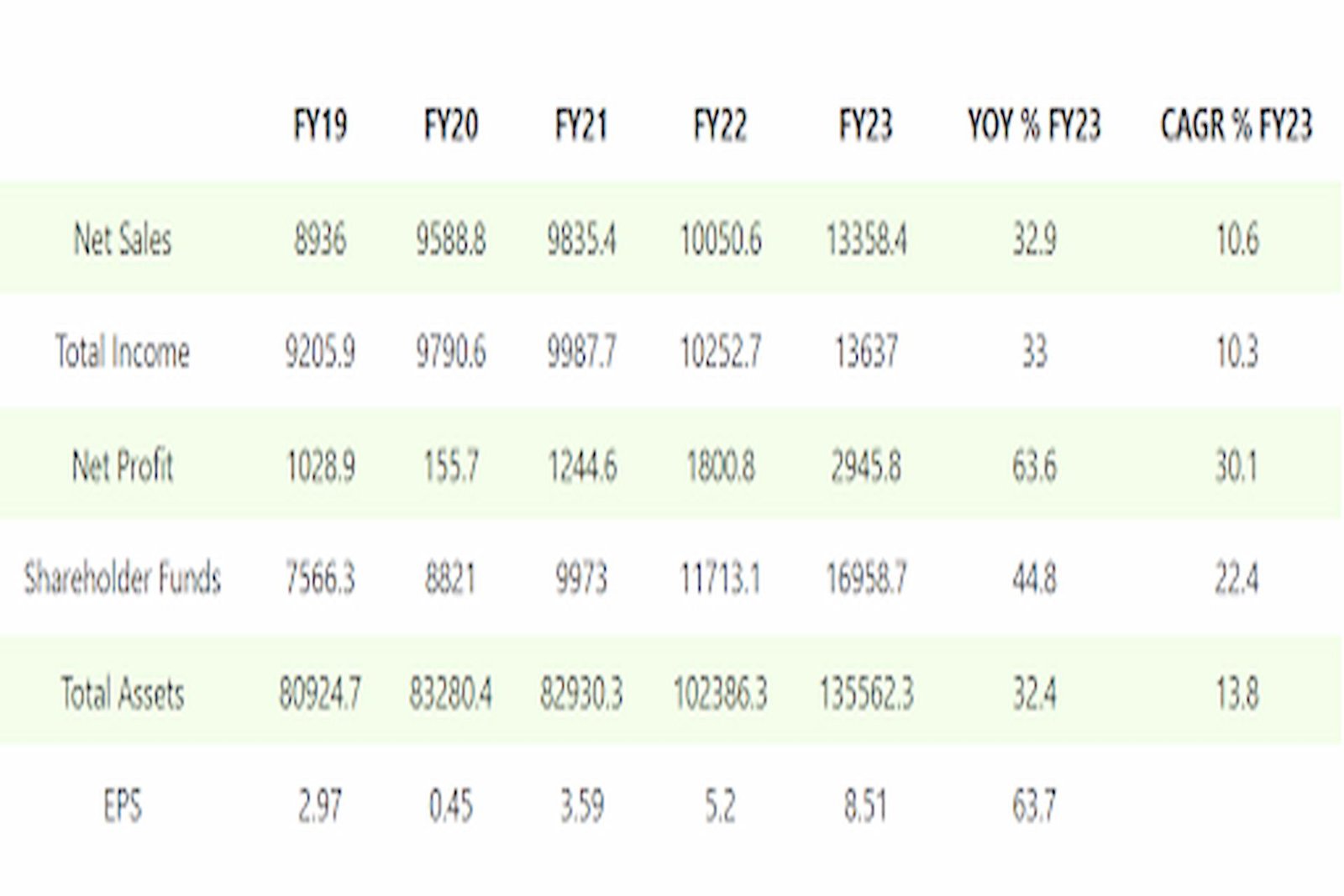

From the table given below, you will get a better idea of the financial performance of Tata Capital over the last few years.

This chart describes the financial performance of Tata Capital in detail. Now, you have a better idea about its financial growth and plan your investment in Tata Capital unlisted shares mindfully.

How Will Consolidation Help Tata Capital?

Behind the consolidation plan, Tata Capital wants to streamline its operation. Tata Capital Limited aims to leverage collective resources and expertise by bringing together various business ventures, such as commercial finance, consumer loan, and wealth management. This consolidation of subsidiaries will help the company to streamline its business process, eliminate redundancies, and foster collaboration among its team. With this, Tata Capital will have better opportunities to explore more opportunities in the market, enhance its value proposition and boost customer experience.

With the amalgamation, the company can provide a unified platform to the customers for accessing and managing their financial needs. The consideration approach will simplify the customer’s journey and offer a comprehensive solution tailored to individual requirements. Overall, Tata Capital’s consolidation of its arms amid regulatory changes will improve the company’s reputation in the financial market, which will eventually impact Tata Capital unlisted shares. So this is high time for investors to invest in Tata Capital unlisted shares to maximise their return on investment. The current Tata Capital share price is Rs. 575, and investors can check more details on online platforms like Stockify before making an investment decision.

Why Should You Invest In Tata Capital Unlisted Shares?

Investing in Tata Capital unlisted shares can offer several benefits to investors. After consolidating with its subsidiaries, the chances of return on investment may increase. Tata Capital, one of India’s most respected and diversified financial companies, has a proven track record of success that significantly built its trust in the market. Investing in Tata Capital pre-IPO shares can potentially enhance the growth prospects and stability of the investment. Tata Capital has established a strong market position in the financial sector. Through its several financial business units, the company offers a wide range of financial solutions that strengthen its position in the market. Tata Capital unlisted shares allow investors to gain exposure to a well-positioned player in a sector with long-term growth potential.

As the company undergoes consolidation, this move can help position the company for better compliance and risk management practice. This alignment with regulatory changes enhances the investors confidence in the company. Moreover, by investing in the Tata Capital unlisted share, investors get an opportunity to diversify their investment portfolio. Therefore investing in Tata Capital’s unlisted share is a win-win game for potential investors seeking great profit from the share market.

Plan Your Investment In Tata Capital Unlisted Shares For Future Benefits

Investing in unlisted shares is always the best choice in order to get a good return on investment (ROI). When you invest in unlisted shares, there are greater chances of increasing prices in the future, once it gets listed. But there are also risks with unlisted shares that can be reduced with proper research. Investors are recommended to consult with the best-unlisted share brokers in India to get the best financial advice before making any investment decision. There are several online trading platforms like Stockify where experts assist potential investors in buying shares!

Leave a Reply

You must be logged in to post a comment.